Table Of Content

As for areas where house prices are expensive, the ceiling is at 150 percent. This means the conforming limit for single-unit homes in high-cost areas is $970,800. While preparing, you should know about different mortgage options available in the market. Though it may sound overwhelming, once you’re well-informed, it should help you make better decisions.

What You Need to Know About Home Loan Basics

The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S.

Formula for calculating a mortgage payment

Then, consider how much you’ll pay in interest over the life of the loan. You can calculate your down payment as either a percentage or a flat dollar amount using the Rocket Mortgage calculator. Test out both options to get a better idea of how it will affect your home costs in the long term and the type of down payment you’ll need to bring to closing. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but you’ll have a higher monthly payment. A longer term will have a lower monthly payment because you’ll pay off the loan over a longer period of time. Paying a lower interest rate in those initial years could save hundreds of dollars each month that could fund other investments.

How to calculate your mortgage payments

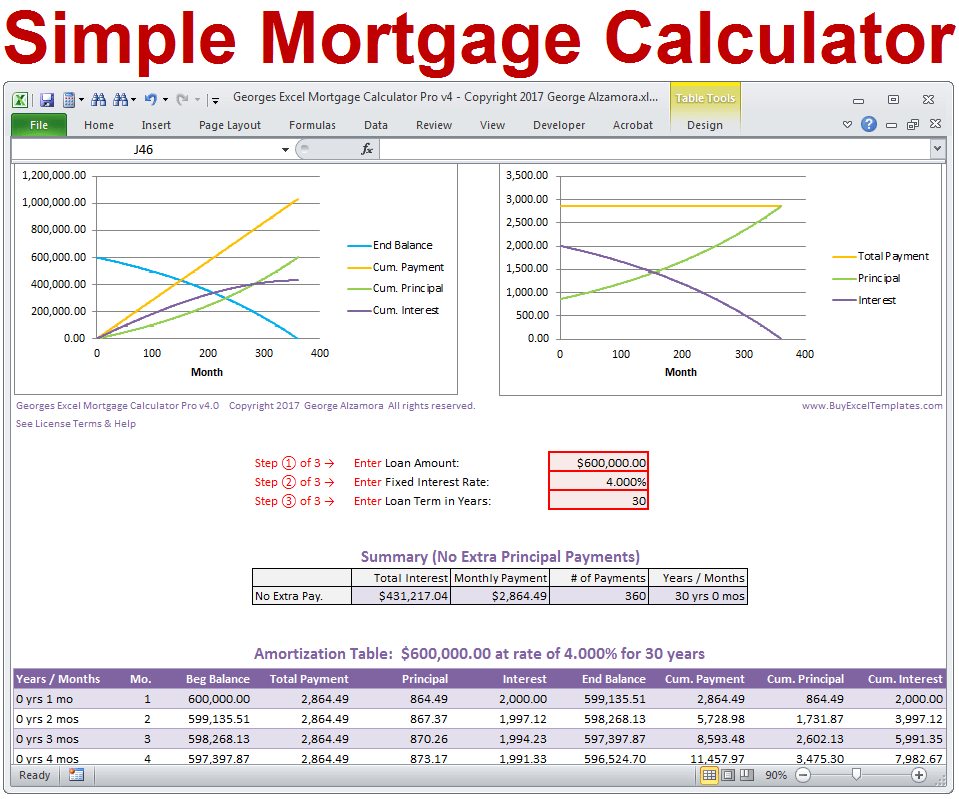

Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options. An amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period. Credit cards, on the other hand, are generally not amortized. They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied.

What is the average mortgage payment on a $300,000 house?

Since last summer, the Fed has consistently kept the federal funds rate at 5.25% to 5.5%. Though the central bank doesn’t directly set the rates for mortgages, a high federal funds rate makes borrowing more expensive, including for home loans. Some lenders may charge a prepayment penalty if the borrower pays the loan off early. From a lender's perspective, mortgages are profitable investments that bring years of income, and the last thing they want to see is their money-making machines compromised.

Bond: Paying Back a Predetermined Amount Due at Loan Maturity

However, it becomes more expensive the longer you pay the loan. Because of this, other borrowers choose to refinance their FHA loan into a conventional loan. This eliminates the PMI requirement and helps them secure a lower rate. In most cases, homeowners who refinance also take shorter terms. Back-end DTI ratio is estimated by adding mortgage-related debts and all monthly debt payments.

It is important to understand the difference between APR and APY. Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the Interest Calculator. For more information about or to do calculations involving APR, please visit the APR Calculator. To calculate your DTI, add all your monthly debt payments, such as credit card debt, student loans, alimony or child support, auto loans and projected mortgage payments.

Are you considering homeownership for the first time, but aren’t sure what kind of house you can afford? If so, a mortgage calculator is a helpful tool that you can use to determine what your monthly mortgage payments might be. A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. Shorter terms help pay off loans quickly, saving on interest. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance.

When you use the Rocket Mortgage® calculator, it’ll factor in frequently overlooked costs like property taxes and homeowners insurance. The VA funding fee offsets the cost of the loan for American tax payers. It’s the compensation you make for offering a low downpayment or none at all. The funding ranges between 1.4% to 3.6% of your loan’s value.

A down payment is a percentage of the purchase price of a home that the buyer pays upfront. For an instant estimate of what you can afford to pay for a house, you can plug your income, down payment, home location, and other information into a home affordability calculator. Lenders will compare your income and debt in a figure known as your debt-to-income ratio.

If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan. A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender's charge to borrow the money.

Whether you need a home loan or you want to refinance your existing loan, you can use Zillow to find a local lender who can help. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. Alternatively, you can always check out how much you can afford by using our very own home affordability calculator.

California Mortgage Calculator - The Motley Fool

California Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

These loans are specifically granted to active military members, veterans, and qualified military spouses. It comes with flexible qualifying standards and a zero downpayment option. Active-duty members and veterans can qualify with a credit score of 620. Due to government sponsorship, VA loan rates are usually lower than conventional loan rates.

No comments:

Post a Comment